megadrive2007.ru Learn

Learn

What Are Us Treasuries

U.S. Treasury bonds are loans given to the federal government in the form of a bill, note or bond. Talk to your financial advisor to learn more. Treasury bonds are debt securities issued by the government. Essentially, you're loaning money to the government by purchasing a bond at a predetermined. Treasury Bills. We sell Treasury Bills (Bills) for terms ranging from four weeks to 52 weeks. Bills are sold at a discount or at par (face value). Treasury note and bond data are representative over-the-counter quotations as of 3pm Eastern time. For notes and bonds callable prior to maturity. Stocks slide as bond sell-off fuels jitters. Tepid demand for new US Treasury auctions drives rates higher and prompts a retreat in major stock indices. U.S. Treasurys ; US 7-YR. , + ; US YR. , + ; US YR. , + ; US YR. , + US Treasury securities are direct debt obligations backed by the full faith and credit of the US government. Interest can be paid at maturity or semiannually. The Department of the Treasury manages federal finances by collecting taxes and paying bills and by managing currency, government accounts and public debt. On a daily basis, Treasury publishes Treasury Par Yield Curve Rates, Treasury Par Real Yield Curve Rates, Treasury Bill Rates, Treasury Long-Term Rates and. U.S. Treasury bonds are loans given to the federal government in the form of a bill, note or bond. Talk to your financial advisor to learn more. Treasury bonds are debt securities issued by the government. Essentially, you're loaning money to the government by purchasing a bond at a predetermined. Treasury Bills. We sell Treasury Bills (Bills) for terms ranging from four weeks to 52 weeks. Bills are sold at a discount or at par (face value). Treasury note and bond data are representative over-the-counter quotations as of 3pm Eastern time. For notes and bonds callable prior to maturity. Stocks slide as bond sell-off fuels jitters. Tepid demand for new US Treasury auctions drives rates higher and prompts a retreat in major stock indices. U.S. Treasurys ; US 7-YR. , + ; US YR. , + ; US YR. , + ; US YR. , + US Treasury securities are direct debt obligations backed by the full faith and credit of the US government. Interest can be paid at maturity or semiannually. The Department of the Treasury manages federal finances by collecting taxes and paying bills and by managing currency, government accounts and public debt. On a daily basis, Treasury publishes Treasury Par Yield Curve Rates, Treasury Par Real Yield Curve Rates, Treasury Bill Rates, Treasury Long-Term Rates and.

Treasury Bills (or T-Bills for short) are a short-term financial instrument that is issued by the US Government's Department of the Treasury. U.S. Treasurys ; US 2-MO. , + ; US 3-MO. , + ; US 4-MO. , + ; US 6-MO. , + The S&P U.S. Treasury Bond Index is a broad, comprehensive, market-value weighted index that seeks to measure the performance of the U.S. Treasury Bond. Treasury bills are good investments for individuals looking to make a large purchase in a short timeline, as the money will only be tied-up for at most a year. Treasury securities—including Treasury bills, notes, and bonds—are debt obligations issued by the U.S. Department of the Treasury. Treasury securities are. The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an. The par value of government debt, which is reported by the U.S. Treasury Department, reflects interest rates at the time the debt was issued while the market. Reasons to choose a US treasury bond, treasuries issued by the US government; features, benefits and risks of treasury bills from Fidelity. There's generally ample availability of Treasury bonds, whereas the availability of CDs can be limited and depends on the bank's capital needs and other factors. Interest income from Treasury securities is subject to federal income tax but exempt from state and local taxes. Income from Treasury bills is paid at maturity. United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury. Created in , the U.S. Treasury is the government (Cabinet) department responsible for issuing all Treasury bonds, notes, and bills. Discover more here. Bonds and Securities. Information dealing with the purchase, redemption, replacement, forms, and valuation of Treasury savings bonds and securities is located. Treasury notes are generally considered to be below-risk and highly liquid fixed-income investments, backed by the US government. You can choose from municipal, government, corporate, mortgage-backed or asset-backed securities and international bonds. Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. What Is a Treasury Bond or T-Bond? Treasury bonds are securities issued by the U.S. government as debt, paid back to investors with interest over 20 or 30 years. DTCC's FICC clears transactions for the U.S. Treasury Market, the largest & most liquid sovereign debt market in the world. U.S. Treasuries are debt instruments issued by the U.S. government to finance its activities. All these Treasury securities – including Treasury bills. Move your savings into a Treasury Account with megadrive2007.ru and invest in US T-bills that pay a higher yield than traditional and high-yield savings accounts.

11 Month Cd

APY for 11 months. %. APY for 15 months. Rates vary by term and location. CD offering a % APY has a term of 11 months, with interest compounded and paid quarterly. We reserve the right to cancel or change the promotion at any time. Discover the benefits of a CD account · Minimum $25, deposit · No maximum deposit · Available on personal, business, & non-profit accounts · Month term. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. 7-Month CD Special, %, %. 7-Month CD Special with Checking1, %, %. Month CD Special, %, %. Restrictions apply. Open an account online. 7-Month No-Penalty CD. % APY. Minimum deposit. $ Annual Percentage 11 Month No-Penalty CD. %. $ No. 13 Month No-Penalty CD. %. $ No. Best CD rates of August (Up to %) · The following accounts can be found at most banks and credit unions. They're federally insured for up to $, No Penalty CD – month term that lets you withdraw all your money any time after the first 6 days following the date you funded the account, and keep the. With these limited-time offers, you benefit from a fantastic % APY for 11 months or % APY for 7 months when you keep your money deposited for the full. APY for 11 months. %. APY for 15 months. Rates vary by term and location. CD offering a % APY has a term of 11 months, with interest compounded and paid quarterly. We reserve the right to cancel or change the promotion at any time. Discover the benefits of a CD account · Minimum $25, deposit · No maximum deposit · Available on personal, business, & non-profit accounts · Month term. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. 7-Month CD Special, %, %. 7-Month CD Special with Checking1, %, %. Month CD Special, %, %. Restrictions apply. Open an account online. 7-Month No-Penalty CD. % APY. Minimum deposit. $ Annual Percentage 11 Month No-Penalty CD. %. $ No. 13 Month No-Penalty CD. %. $ No. Best CD rates of August (Up to %) · The following accounts can be found at most banks and credit unions. They're federally insured for up to $, No Penalty CD – month term that lets you withdraw all your money any time after the first 6 days following the date you funded the account, and keep the. With these limited-time offers, you benefit from a fantastic % APY for 11 months or % APY for 7 months when you keep your money deposited for the full.

Earn up to % APY* from your money and open an month CD Special*. · certificates. Choose the level of commitment that's right for your CD savings ; 18 Months, %, $ ; 24 Months, %, $ ; 30 Months, %, $ ; 36 Months, %, $ Certificate of Deposit ; 5 Month - CD Special, %, % ; 11 Month - CD Special, %, % ; 3 Month, %, % ; 12 Month, %, %. Lock in a fixed rate with an online-only certificate of deposit with month and 8-month CDs at Citizens. View online CD rates and open an account today. APY for 11 months. %. APY for 15 months. Rates vary by term and location. Certificate of Deposit ; 36 Month, %, % ; 48 Month, %, % ; 60 Month, %, % ; 11 Month Online, %, %. 7-Month. No-Penalty CD. %. $ No. Month. No-Penalty CD. %. $ No. Month. No-Penalty CD. %. $ No. 6-Month. CD. %. $ Yes. CD rates can vary depending on the term and type of CD account you choose. Learn about current CD rates for Fixed Rate, Step Up and No Penalty CDs. Competitive rates on CD accounts ; 11 months. % APY ; 12 months. % APY ; 13 months. % APY ; 15 months. % APY. Standard Certificate of Deposit Rates ; Month CD, $1,, % ; Month CD, $1,, % ; Month CD, $1,, % ; Month CD. Visit now to learn about TD Bank's certificate of deposit offers, interest rate increases on our 6, 12 and 18 month CDs. Get your CD started online today! Bump-Up CD 24 Months. · Earn with confidence. ; Certificate of Deposit (CD) · · Lock in for higher rates. ; No-Penalty CD 11 Months. · Flexible and. * The CD rates are quoted as of August 14, The 3, 6 and month CDs will pay coupons at maturity. State restrictions may apply. Rate refers to the. Month CD Rates - % APY* Earn the best interest rates we have to offer with our certificates of deposit (CDs)! We are now offering a special Month CD. CD Benefits ; Month CD Rate with Member Advantage. · 12 - 17 Month CD with Member Advantage ; Month CD Rate. · 12 - 17 Month CD ; Month CD. 11 Months. % ; 12 Months. % ; 18 Months. % ; 24 Months. % ; 36 Months. %. *Annual Percentage Yields (APY) of % on an 9-month CD and % on a month CD available only to customers who have or who open and fund any personal. Applies to new CDs opened with $25, or more in new money Open an account. 11 month cd APY 5%. Month CD. Month, Deposit, Interest, Ending balance. 1, $10,, $, $10, 2, $ 11, $, $, $10, 12, $, $, $10, End of. Capital One is offering 5% on an 11 month CD that is compounded monthly. Does monthly compound mean that every month interest is earned from.

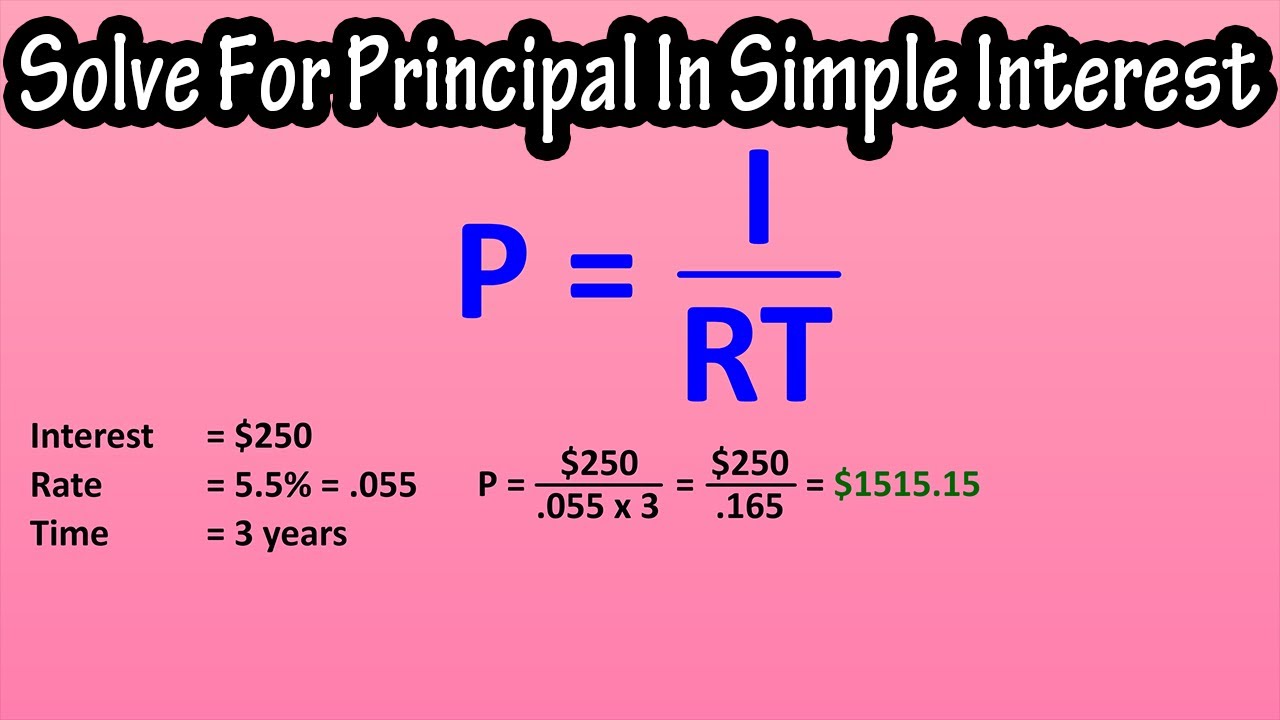

Simple Intrest Rate

To calculate simple interest on a loan, multiply the principal amount P by the interest rate R and the time t (in years) using the formula I=P*R*t. How to. Simple interest calculator finds the principal amount, interest amount and interest rate using simple interest formula. This calculator can help you deal. The formula to calculate simple interest is made up of multiplying three factors: principal amount, rate, and time. The principal is the original amount of. Definitions: Principal is the amount of money borrowed. The interest rate is given as a percent. Time is the length of. You can calculate simple interest by multiplying the daily interest rate by the principal by the number of days that elapse between payments. Watch our. Multiply your principal balance by your interest rate. Divide your answer by days ( days in a leap year) to find your daily interest accrual or your. Simple Interest (S.I.) is the method of calculating the interest amount for a particular principal amount of money at some rate of interest. For example, when a. Simple interest is calculated by finding a percent of the principal (original) amount and multiplying by the time period of the investment. The final value of. Calculate simple interest effortlessly with the formula I = P x R x t, Where I represents interest, P is the principal and R is the rate. To calculate simple interest on a loan, multiply the principal amount P by the interest rate R and the time t (in years) using the formula I=P*R*t. How to. Simple interest calculator finds the principal amount, interest amount and interest rate using simple interest formula. This calculator can help you deal. The formula to calculate simple interest is made up of multiplying three factors: principal amount, rate, and time. The principal is the original amount of. Definitions: Principal is the amount of money borrowed. The interest rate is given as a percent. Time is the length of. You can calculate simple interest by multiplying the daily interest rate by the principal by the number of days that elapse between payments. Watch our. Multiply your principal balance by your interest rate. Divide your answer by days ( days in a leap year) to find your daily interest accrual or your. Simple Interest (S.I.) is the method of calculating the interest amount for a particular principal amount of money at some rate of interest. For example, when a. Simple interest is calculated by finding a percent of the principal (original) amount and multiplying by the time period of the investment. The final value of. Calculate simple interest effortlessly with the formula I = P x R x t, Where I represents interest, P is the principal and R is the rate.

The $1, is our principal, 4% is our interest rate, and five is t in terms of years. Notice that the rate is an annual rate, and our time periods are in years. Simple Interest: Calculated annually on the amount you deposit or owe. Compound Interest: Interest earned is added to the principal, forming a new base on which. Annual interest rate: The percentage interest that the bank (or any other institution that you borrowed the money from) is charging you for the funds they lend. Simple interest calculator. Home > Tools > Simple Visit our insights page for articles, newsletters, podcasts and more. Calculator. Interest rate. %. A simple interest loan is a type of loan where the interest is calculated solely on the initial principal amount over the entire duration of the loan. We multiply the principal amount, rate of interest (in decimal form), and time period to find the simple interest. So, the interest is $ An example of a simple interest calculation would be a 3 year saving account at a 10% rate with an original balance of $ By inputting these variables into. Simple interest refers to the amount of money paid or earned on the principal over a set period of time (term). For instance, if you place money in the bank . Present value (P) If one is going to be paid $ in two weeks, and the interest rate is 12%, the principal one can borrow now is P = $/(1 +×(2/52)). To calculate simple interest, the formula used is (P x r x t)/ where P, r, and t stands for principal amount, rate of interest and tenure of the deposit in. Interest can refer to the cost of borrowing money in the form of interest charged on a loan or to the rate paid for money on deposit. · Simple interest is only. Amount borrowed is $20,; Interest rate, or APR, is %; Fixed monthly payment is $ Your daily finance charge would be calculated as follows: ($. The amount of money that you lend or borrow is called the principal. The length of the loan can range between a few days to several years. The interest rate is. Simple Interest: Calculated annually on the amount you deposit or owe. Compound Interest: Interest earned is added to the principal, forming a new base on which. Use the simple interest formula. Enter the amount of the principal (P), then multiply it by the interest rate (r) in decimal form. Multiply the result by the. The calculation of simple interest is equal to the principal amount multiplied by the interest rate, multiplied by the number of periods. For a borrower, simple. There are two distinct methods of accumulating interest, categorized into simple interest or compound interest. rate calculated from prevailing interest rates. On the simple interest version, the annual rate of 6% is divided by , converting it to a daily rate of%. The daily rate is multiplied by the loan. Mr. A has invested an amount of Rs. at an interest rate of 5% for almost 2 years. So his SI will be calculated as Rs. ( X 5 X 2/) which is equal. Simple Interest Calculator Compound Interest means that you earn "interest on your interest", while Simple Interest means that you don't - your interest.

What Should A Young Person Invest In

These include investments like U.S. Treasury bonds, CDs, or other types of fixed income investments that can be more stable than stocks. Aggressive asset. Want: Something that you would like to have but that you could live without, such as a TV or tickets to a baseball game. Conversation Starters Ask Your Teen. 1. Invest in the S&P As a young investor, your investments should be concentrated on growth-oriented assets. That's because in the decades ahead of you. Young investors should invest in low fee index funds in the beginning. Invest 75% of your investments in stocks and get stock market return on. Young adults face a vast array of investment options from real estate to retirement plans and short-term investments. Be cautious when buying products or. When you're young, you generally want higher returns that stocks, stock-based mutual funds, or ETFs can provide – rather than slower-growing investments like. Young Person Should Know. 1. Map your financial future. Take time to list money you invest. Diversification of assets is the best protection against. The safest investments for youth include fixed-income options like mutual funds, bonds, and fixed deposits that offer predictable returns with lower risks. The bottom line. Income-focused investing is a stable, conservative approach to investing your money if your objective is less about capital gains and more. These include investments like U.S. Treasury bonds, CDs, or other types of fixed income investments that can be more stable than stocks. Aggressive asset. Want: Something that you would like to have but that you could live without, such as a TV or tickets to a baseball game. Conversation Starters Ask Your Teen. 1. Invest in the S&P As a young investor, your investments should be concentrated on growth-oriented assets. That's because in the decades ahead of you. Young investors should invest in low fee index funds in the beginning. Invest 75% of your investments in stocks and get stock market return on. Young adults face a vast array of investment options from real estate to retirement plans and short-term investments. Be cautious when buying products or. When you're young, you generally want higher returns that stocks, stock-based mutual funds, or ETFs can provide – rather than slower-growing investments like. Young Person Should Know. 1. Map your financial future. Take time to list money you invest. Diversification of assets is the best protection against. The safest investments for youth include fixed-income options like mutual funds, bonds, and fixed deposits that offer predictable returns with lower risks. The bottom line. Income-focused investing is a stable, conservative approach to investing your money if your objective is less about capital gains and more.

1. Custodial Roth IRAs A custodial Roth IRA is a retirement account an adult — usually a parent — opens on behalf of a child. The adult controls the account. “For young people, even though you may not have much in the way of savings, getting started with investing is a way to help build your savings,” shares Booth. “. JISAs have a distinct benefit over other investment methods, as any gains grow free of tax, and the child is also able to manage the investment choices. One can start a monthly SIP with amounts as low as Rs. to start growing their wealth. Even small monthly SIP can help young investors generate a substantial. You should take this $15, and invest in YOURSELF. Travel and meet the best website designers in person and learn from them. Take that money. The answer is to Invest in the stock market and specially the SPY The SPY is an index of all the top largest companies in America. For long-term goals, the range of possibilities is somewhat wider: for example, stocks, corporate and government bonds, long-term CDs, mutual funds. You should. Overall, I highly recommend Investing for Young Adults to anyone looking to take control of their financial future. It's an invaluable resource that has already. Exchange-traded funds offer several advantages for young investors: they provide instant diversification across a basket of stocks with a single purchase. One of these investments could be in the stock market. Another could be in mutual funds, which are basically pools of money that investors invest in a variety. Invest (pre-tax) monthly in an IRA or K program. Do so every month and select a diversified investment program in passive ETF's across. Help your teen learn about money. The Fidelity Youth® Account gives teens the power to save and invest their money. Learn more. Investing in stocks, bonds and mutual funds offers the potential to grow your investment faster than a simple savings account. Discover the benefits of investing early · Compound interest is when your child earns interest on both the money they save and the interest they earn. Almost everyone should own stocks or stock-based investments like exchange-traded funds (ETFs) and mutual funds (more on those in a bit). Stocks have. Keep in mind that when investing in stocks, you shouldn't just be throwing your money at random individual stocks. A tried-and-true strategy is to invest in. Advantages of Learning to Invest as a Teenager · What Teens Will Learn about Investing · Investing When You are Almost Broke · Custodial Accounts for Teen. While savings for short-term goals should be in cash, a mix of stocks and bonds are essential to growing your wealth to fund long-term goals like retirement or. For young investors in their 20s, experts recommend portfolios skewed toward stocks or equity funds due to their potential for long-term growth. Diversification. You have the benefit of time so should maximise the opportunity for growth by investing in shares. When it comes to picking which companies to invest in, there.

Farm Animals For Sale On Craigslist

Farm & Garden for sale in Northwest GA. see also. LOOK NEW BOBCAT TRACTOR Livestock guardian dog - Komondor x Great Pyrenees. $ · Goat Stand. $ Farm & Garden for sale in Northern WI. see also. Case 85XT skidsteer. $19, Dog kennel metal animal crate. $0. Rhinelander · JAZZY AIR 2 electric. Find farm & garden - by owner for sale in City Of Atlanta. Craigslist helps you find the goods and services you need in your community. Interested in Adopting? We have hundreds of dogs and puppies (big and small!) at Big Dog Rescue Ranch. Your new best friend is waiting for you! Sheep 4 sale lake Matthew! 8/28·. for sale · Toy Farm Animals Plastic PVC Plush Horses Vintage Fisher Price Barn 1 · Wood Small Animal Cages 1 · DWARF NIGERIAN GOATS - PRICED TO SELL 1 · GRASS. farm+garden · Living Quarters Horse Trailer 1 Living Quarters Horse Trailer · Bobcat CT Tractor & Loader 1 · Pay On Delivery! · Shipping Container FOR. Farm & Garden for sale in Eastern NC. see also. Flex 18" Leather Saddle. $ Livestock farm working dogs Dutch Shepherds. $0. Rocky Mount · 2 Car QUALITY. for sale · Group antique horses, cowboys, farm animals 1 · Lodge Chicken Coop 1 · Farm animals 1 · Roman - Saanen goat, wether, packing animal, 4H project 1. Farm & Garden for sale in Northwest GA. see also. LOOK NEW BOBCAT TRACTOR Livestock guardian dog - Komondor x Great Pyrenees. $ · Goat Stand. $ Farm & Garden for sale in Northern WI. see also. Case 85XT skidsteer. $19, Dog kennel metal animal crate. $0. Rhinelander · JAZZY AIR 2 electric. Find farm & garden - by owner for sale in City Of Atlanta. Craigslist helps you find the goods and services you need in your community. Interested in Adopting? We have hundreds of dogs and puppies (big and small!) at Big Dog Rescue Ranch. Your new best friend is waiting for you! Sheep 4 sale lake Matthew! 8/28·. for sale · Toy Farm Animals Plastic PVC Plush Horses Vintage Fisher Price Barn 1 · Wood Small Animal Cages 1 · DWARF NIGERIAN GOATS - PRICED TO SELL 1 · GRASS. farm+garden · Living Quarters Horse Trailer 1 Living Quarters Horse Trailer · Bobcat CT Tractor & Loader 1 · Pay On Delivery! · Shipping Container FOR. Farm & Garden for sale in Eastern NC. see also. Flex 18" Leather Saddle. $ Livestock farm working dogs Dutch Shepherds. $0. Rocky Mount · 2 Car QUALITY. for sale · Group antique horses, cowboys, farm animals 1 · Lodge Chicken Coop 1 · Farm animals 1 · Roman - Saanen goat, wether, packing animal, 4H project 1.

Two Great Pyrenees dogs for sale! 9/9·East houston. $ Farm animals: yes, you can sell, for example, goats and pigs and chickens. No problem. Post them in the “farm” section. Pets like puppies? craigslist. Farm & Garden - By Owner "animals" for sale in Chicago. see also. FLOWER POT Plant BOX Crate Garden Decoration Bemis Nurturing Planter. Farm & Garden for sale in Northern WI. see also. Case 85XT skidsteer. $19, Dog kennel metal animal crate. $0. Rhinelander · JAZZY AIR 2 electric. Chihuahua puppies for sale. $ Trenton · kunekune piglets. $ Batesburg Call For Limited-Time Sale Price! Farm Animals. $15 · C&B "The Tribble" Cattle. Farm & Garden for sale in Central Michigan. see also. Food plots Yanmar 4 New Power Dog Tillers & Mowers. $4, Clare · Hay Wagon/Parade Float. Farm & Garden for sale in Tyler / East TX. see also. Hereford/Brahman bull animal or tool storage unit-all aluminum. $ Tyler · Honda Generator. $ Farm & Garden for sale in Little Rock. see also. Hay for sale. $ Lonsdale · Kune kune mix piglets. $ Brockwell · CLOSEOUT 5X8 TRIPLE R ENCLOSED. $3, Farm animals for sale. 9/10·. hide. AMERICAN AG ANNUAL FALL MACHINERY AUCTION 9/3·Talk To An Expert Now! hide. Shipping Containers for SALE! Farm & Garden for sale in Tri-cities, TN. see also. Pot belly pigs. $40 Farm Animals for sale. $1. Greeneville · February Ewes sheep. $ Bristol. Kentwood real Farming wight/cali/megadrive2007.rus offspring is processor accepted. $ Kentwood · Rabbit or animal carrier/transport to sell,quality cageing. Chicks 4 Sale Ayam Cemani, Zombie, Ameracana, ETC. $3. Jefferson Ga · Unwanted farm animals. $0 · Dorper ewes. $ Carnesville · Pair of Blitz Riding Mower. Farm & Garden for sale in Western KY. see also. Aussie. $ Lowes · pygmy Farm Animals. $0. Gleason TN · NEW LOWES 32" SOLID CORE 2 PANEL DOOR. $ Farm & Garden for sale in Lexington, KY. see also. Tabby kittens. $0 Dog Training Specialist. $0. mt sterling · Dog Training Specialist. $0. mt sterling. Farm & Garden for sale in Little Rock. see also. Pay On Delivery! Shipping Large Dog ThunderShirt Grey New. $ Sherwood · Rabbits- bunnies (New. Riding Mower's FOR SALE. 9/10·TOMAHAWK. hide. Craftsman T riding mower 1 Daniels Septic and Precast: Livestock Feeders and Agriculture Products. 9. Farm & Garden for sale in Greenville / Upstate. see also. 84" HYDRAULIC Homestead / Farm animals for sale. $1, Pickens, SC · Roosters Rhode Island. 9/5·Sycaway (Troy up Hoosick Street). $5 hide. no image · Straw NEEDED. 8/26·Broadalbin. hide. no image · farm animal tailgate sale 8/18 NO DOGS. WEED EATERS,FEW PUSH MOWERS. 8/3·BECKLEY WEST VIRGINIA. $1, hide. Puppies for Sale 1. ••••. Puppies for Sale. 7/30·ELKVIEW. $ hide. Star trek toys 1. New Custom Classic Livestock Trailer. 9/10·Fairbank. $27, hide. Shipping Container FOR SALE - Payment On Delivery 1. ••••••••••••••••••••••••.

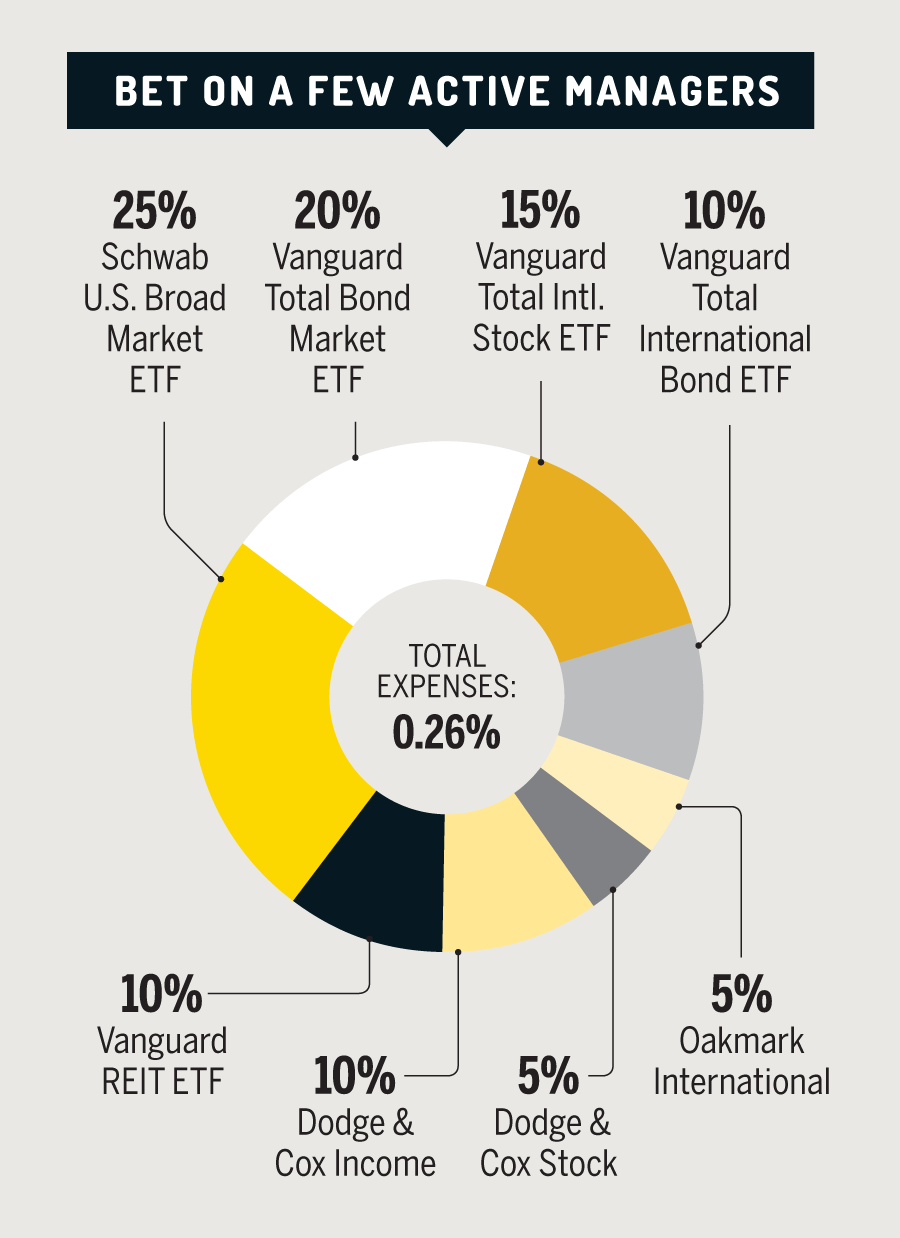

Best Fidelity Asset Allocation Funds

Based on year annualized returns, the best-performing Fidelity mutual fund as of Dec. 31 is the Fidelity Select Semiconductor Portfolio (FSELX), which has. Fidelity Canadian Asset Allocation Fund · NAV $ $ / %. Aug · Inception Dec · Benchmark Blended Index** · Aggregate assets (all series). Explore Fidelity's strategic asset allocation investment solutions Build better portfolios with mutual funds tailored to meet your clients' needs. Fidelity now offers the Fidelity ZERO Large Cap Index Fund (FNILX), Fidelity ZERO Extended Market Index Fund (FZIPX), Fidelity ZERO Total Market Index Fund . Morningstar. Overall rating · Fidelity American Balanced Fund Global Equity Balanced · Fidelity American High Yield Fund · Fidelity · Fidelity Balanced Income. Fidelity Small Cap Value. FISVX. 10% ; Fidelity® Real Estate Index Fund. FSRNX. 10% ; Fidelity® ZERO International Index. FZILX. 10% ; iShares MSCI EAFE Value (ETF). Today more than ever, a one-stop approach to portfolio diversification may be your best choice. We offer various types of asset allocation funds to serve. The Fidelity Capital & Income Fund (FAGIX) is another 5-star balanced fund that is tilted much more heavily toward bonds, with roughly 75% of the portfolio. Fidelity offers over mutual funds from dozens of different mutual fund companies and can help you find the right ones for. Based on year annualized returns, the best-performing Fidelity mutual fund as of Dec. 31 is the Fidelity Select Semiconductor Portfolio (FSELX), which has. Fidelity Canadian Asset Allocation Fund · NAV $ $ / %. Aug · Inception Dec · Benchmark Blended Index** · Aggregate assets (all series). Explore Fidelity's strategic asset allocation investment solutions Build better portfolios with mutual funds tailored to meet your clients' needs. Fidelity now offers the Fidelity ZERO Large Cap Index Fund (FNILX), Fidelity ZERO Extended Market Index Fund (FZIPX), Fidelity ZERO Total Market Index Fund . Morningstar. Overall rating · Fidelity American Balanced Fund Global Equity Balanced · Fidelity American High Yield Fund · Fidelity · Fidelity Balanced Income. Fidelity Small Cap Value. FISVX. 10% ; Fidelity® Real Estate Index Fund. FSRNX. 10% ; Fidelity® ZERO International Index. FZILX. 10% ; iShares MSCI EAFE Value (ETF). Today more than ever, a one-stop approach to portfolio diversification may be your best choice. We offer various types of asset allocation funds to serve. The Fidelity Capital & Income Fund (FAGIX) is another 5-star balanced fund that is tilted much more heavily toward bonds, with roughly 75% of the portfolio. Fidelity offers over mutual funds from dozens of different mutual fund companies and can help you find the right ones for.

The company has active and indexed strategies, as well as target date and other asset allocation portfolios. Its Fidelity Select series offers exposure to a. Fidelity Asset Manager® 85%. %, %, %, % ; Aggressive Allocation. Close. %, %, %, %. Currently, FFIJX's portfolio features an allocation of roughly 55% in U.S. stocks, % in international stocks and % in bonds. However, as time goes on. Fidelity Asset Manager 40% has securities in its portfolio. The top 10 holdings constitute % of the fund's assets. The fund meets the SEC requirement. Whether you want to pick your own funds or prefer the hands-off approach, we'll help you explore ways to select a diversified portfolio. Fidelity Asset Manager funds are diversified single-fund strategies that can help make it easy to maintain a portfolio based on risk tolerance. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Today more than ever, a one-stop approach to portfolio diversification may be your best choice. Not FDIC Insured • May Lose Value • No Bank Guarantee. Page 3. I have Fidelity for my Roth IRA and I only have $ to put in for now and i might put $ each month depending on my income. From the. Each maintains an asset allocation containing between 20% and 85% stocks. You simply select the portfolio that best matches your comfort level regarding. View all of Fidelity's mutual funds and start searching for your next investment. Bond Funds; Alternatives; Commodity; Asset Allocation. Fidelity® Multi-Asset Index Fund. %, %, %, % ; Moderately Aggressive Allocation. Close. %, %, %, %. Investing for retirement, simplified. Choose the fund that best aligns with your planned retirement year to get a complete portfolio in a single investment. Fidelity Asset Manager® 40% · Fidelity® Strategic Real Return Fund · Fidelity® Multi-Asset Income Fund · American Funds Tax-Aware Conservative Growth and Income. Lastly, when building your portfolio, it's essential to know that all investment types have different advantages and risks to consider. The top 10% of funds in each fund category receive 5 stars, the next % receive 4 stars. Is one fund that contains a fully diversified portfolio. Asset. Fidelity Asset Manager 20% has securities in its portfolio. The top 10 holdings constitute % of the fund's assets. The fund meets the SEC requirement. The best index funds can help you build wealth by diversifying your portfolio while minimizing your fees. Investing in an index fund is less risky than. Diversification and asset allocation do not ensure a profit or guarantee against loss. Investing in municipal bonds for the purpose of generating tax-exempt. The 6 Best Fidelity Mutual Funds to Buy and Hold · Fidelity Index Fund (FXAIX) · Fidelity Total Market Index Fund (FSKAX) · Fidelity Zero Total Market Index.

How Big Of A House Can I Afford To Build

Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. For example, if your construction budget is $,, and homes in that price range typically start around $ per square foot, then you can afford roughly. How Much House can I Afford? If you make a down payment below 20% of the home price, you may be required to purchase Private Mortgage Insurance (PMI). What's. I'm not sure you can build a house for less than $K, so you would be looking at borrowing $K+ at a much higher rate than you currently. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. Not sure how much mortgage you can afford? Use the calculator to discover how much you can borrow and what your monthly payments will be. 1. Evaluate Your Current Financial Situation · 2. Estimate Closing Costs and Additional Fees · 3. Consider Your Down Payment Options · 4. Determine Your House. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. For example, if your construction budget is $,, and homes in that price range typically start around $ per square foot, then you can afford roughly. How Much House can I Afford? If you make a down payment below 20% of the home price, you may be required to purchase Private Mortgage Insurance (PMI). What's. I'm not sure you can build a house for less than $K, so you would be looking at borrowing $K+ at a much higher rate than you currently. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. Not sure how much mortgage you can afford? Use the calculator to discover how much you can borrow and what your monthly payments will be. 1. Evaluate Your Current Financial Situation · 2. Estimate Closing Costs and Additional Fees · 3. Consider Your Down Payment Options · 4. Determine Your House.

No more than 30% to 32% of your gross annual income should go to mortgage expenses, such as principal, interest, property taxes, heating costs and condo fees. How much house can I afford based on my salary? Take account of your financial readiness to buy a house by applying the 28/36 rule. Lenders generally want to. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. If you're looking at a home as a way to build wealth, renting and How much house can you afford? How much money do you need to save to buy a. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. How much you can afford to spend on a home depends on several factors, including these primary factors: you and your co-borrower's annual income, down payment. To determine how much house you can afford, use this home affordability calculator to get an estimate of the home price you can afford based upon your income. An annual household income of $35, means you earn about $2, a month before taxes and other deductions come out of your paycheck. Your mortgage lender will. But when you build a new home, the minimum down payment on your construction loan is likely be higher, at least 5% to 10% of the total construction cost, and. Before you start shopping for a new home, you need to determine how much house you can afford. One way to start is to get pre-approved by a lender, who will. There are two House Affordability Calculators that can be used to estimate an affordable purchase amount for a house based on either household income-to-debt. But if you can afford a good lot that is clear to build on, yes it can be much cheaper to build your own, generally anywhere from (maybe, again. We provide this free, industry leading, home construction cost calculator to understand exactly what you can afford before you purchase a floor plan. Know these terms & how they work. The 28/36 rule. This is a common-sense rule to calculate how much debt you should assume. How it works: Your total housing. However, a 50% debt-to-income ratio isn't going to get you that dream home. Most lenders recommend that your DTI not exceed 43% of your gross income.2 To. Understanding the 28/36 rule for home affordability · You should spend no more than 28% of your monthly income on your housing payment · Your total debts —. Mortgage Qualifier Calculator. The first steps in buying a house are ensuring you can afford to pay at least 5% of the purchase price of the home as a down. The optimal size of the house is somewhere between 25square feet. Within this range your actual cost per square foot will be lowest on building new. Understand how much house you can afford. This mortgage affordability calculator provides an idea of your target purchase price, and it's based on some.

Mortgage Interest Rates Trending

Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until Current mortgage interest rates and trends in Switzerland. The UBS interest rate chart gives you an overview of trends in mortgage interest rates. Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage. Prediction of Mortgage Rates for · Fannie Mae: % · Mortgage Bankers Association: % · National Association of Home Builders: % · National Association. Mortgage Rates Trending Lower · year fixed-rate mortgage averaged percent as of April 6, , down from last week when it averaged percent. A year. The national average mortgage rate is %. Find out what your personal rate could be. Check our rates. National average rates. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. The average year fixed mortgage rate decreased to % this week, down from an average of % last week. A year ago at this time, the year rate. Mortgage rate predictions for The year fixed-rate mortgage averaged % as of Sept. 12, according to Freddie Mac. All five major housing authorities. Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until Current mortgage interest rates and trends in Switzerland. The UBS interest rate chart gives you an overview of trends in mortgage interest rates. Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage. Prediction of Mortgage Rates for · Fannie Mae: % · Mortgage Bankers Association: % · National Association of Home Builders: % · National Association. Mortgage Rates Trending Lower · year fixed-rate mortgage averaged percent as of April 6, , down from last week when it averaged percent. A year. The national average mortgage rate is %. Find out what your personal rate could be. Check our rates. National average rates. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. The average year fixed mortgage rate decreased to % this week, down from an average of % last week. A year ago at this time, the year rate. Mortgage rate predictions for The year fixed-rate mortgage averaged % as of Sept. 12, according to Freddie Mac. All five major housing authorities.

What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. The year fixed mortgage rate on September 14, is down 19 basis points from the previous week's average rate of %. Additionally, the current national. % – Effective as of: September 14, What is Prime Rate? The Prime Rate is the interest rate that banks use as a basis to set rates for different. Mortgage rates have been going back up because the year treasury yield is going up. Treasury yields are based on demand for “risk-free”. View today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing. Mortgage interest rates have shifted from nearly 19% in to % in for year fixed-rate home loans. Keep track of current trends in mortgage interest rates with our interest rate forecasts in order to ensure the ideal structure for your property financing. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. The 30 Year Mortgage. Mortgage rates are finally moving in a favorable direction for buyers. Rates have fallen for the fifth week in a row, bringing the average year fixed rate to. The average rate on a year fixed mortgage dropped to % as of September 12th, reaching its lowest level since February , according to Freddie Mac. This. On Friday, Sept. 13, , the average interest rate on a year fixed-rate mortgage dropped nine basis points to % APR. The average rate on. The current mortgage interest rates forecast is for rates to continue on a gentle downward trajectory over the remainder of 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. The 30 Year Mortgage. Mortgage Rates ; Today's Mortgage Rates by State – Sept. 13, · Jen Hubley Luckwaldt ; Mortgage Refinance Rates Tick Up From Month Low · Jen Hubley Luckwaldt. Rate % ; APR % ; Points ; Monthly Payment $1, The average contract interest rate for year fixed-rate mortgages with conforming loan balances ($, or less) declined by 14bps to % in the week. Mortgage rates trend up when interest rates go up, and they trend down when rates decrease. Tracking mortgage rate trends can help you predict where interest. As October approaches, rates have continued to fall, finally getting closer to 6% for year mortgages recently. The Federal Reserve is expected to make a rate. Mortgage rates change often and can be unpredictable. You may want to consider locking your mortgage rate if: Rates are rising: If rates are trending upward for. Interest costs over 30 years Over 30 years, an interest rate of % costs $, more than an interest rate of %. With the adjustable-rate mortgage.

Home Loans With Itin Number

ITIN loans in Texas are a popular option for individuals who do not qualify for traditional mortgage loans. If you are looking for home financing and do not have or are not eligible to obtain a Social Security number, our ITIN Mortgage Program may be a great option. We offer home loan solutions to our members that currently do not have Social Security Numbers, but have Individual Taxpayer Identification Numbers (ITINs). Individual Tax Identification Number (ITIN) loans are for clients with ITIN identification and who do not have Social Security Numbers or green cards, don't. Our Non-QM home loans let you use a US individual taxpayer identification number (or ITIN for short) along with other documents, to apply. Our ITIN mortgage loan program is a mortgage solution for individuals who have an Individual Taxpayer Identification Number but do not have a Social Security. Designed specifically for ITIN holders and non-US residents with valid SSNs, our HOPP/ITIN home loan opens up the pathway to homeownership. Designed for homebuyers who do not have a Social Security number, this program lets eligible borrowers apply using their Individual Taxpayer Identification. A California ITIN loan can help individuals without a Social Security number (SSN) become a homeowner or real estate investor in the Golden State. ITIN loans in Texas are a popular option for individuals who do not qualify for traditional mortgage loans. If you are looking for home financing and do not have or are not eligible to obtain a Social Security number, our ITIN Mortgage Program may be a great option. We offer home loan solutions to our members that currently do not have Social Security Numbers, but have Individual Taxpayer Identification Numbers (ITINs). Individual Tax Identification Number (ITIN) loans are for clients with ITIN identification and who do not have Social Security Numbers or green cards, don't. Our Non-QM home loans let you use a US individual taxpayer identification number (or ITIN for short) along with other documents, to apply. Our ITIN mortgage loan program is a mortgage solution for individuals who have an Individual Taxpayer Identification Number but do not have a Social Security. Designed specifically for ITIN holders and non-US residents with valid SSNs, our HOPP/ITIN home loan opens up the pathway to homeownership. Designed for homebuyers who do not have a Social Security number, this program lets eligible borrowers apply using their Individual Taxpayer Identification. A California ITIN loan can help individuals without a Social Security number (SSN) become a homeowner or real estate investor in the Golden State.

RGCU offers offer a home loan solution to our members who have Individual Taxpayer Identification Numbers (ITINs) instead of Social Security Numbers. ITIN home loans are your legal and secure pathway to homeownership in the United States. Talk with Prysma about securing a loan with your ITIN number today. You should consider that debt consolidation may increase the total number of monthly payments and the total amount paid over the term of the loan. To enjoy. We offer a variety of loans to individuals with an Individual Tax Identification Number (ITIN). With Peninsula Credit Union, you can achieve your financial. Program Details · $, maximum loan amount* · Up to 95% financing** · No Private Mortgage Insurance (PMI) · Available for single-family residences that are. If you do not have and are not eligible to obtain a Social Security number, our ITIN Mortgage Program can help you purchase a home. We are proud to offer ITIN Home Loans, specifically designed for foreign nationals and individuals who possess an Individual Taxpayer Identification Number . Wanting to buy a home with ITIN(Individual Taxpayer Identification Number) % financing for first time home buyers even with ITIN's. If you are a Non-U.S. Citizen and have an Individual Taxpayer Identification Number (ITIN), an ITIN Home Mortgage Loan may be the right fit for you. Everyone deserves an opportunity to own a home. If you have an individual taxpayer identification number (ITIN) rather than a social security number (SSN), our. ITIN Mortgage Requirements. Purchase and refinance options available. Financing options for owner-occupied properties, second homes and investment properties. However, you provide your ITIN number instead of a Social Security number, which is used for all tax-related purposes associated with the loan. Benefits of an. number apply for a loan using their ITIN. ITIN home loan features: 5. Borrowers. Non-permanent resident aliens; natural persons with legal capacity, and DACA. A specialty loan for those who have an Individual Tax Identification Number and can benefit from a home-buying course. No Social security number? Don´t worry! Our ITIN loan program is available ITIN Home Loan. An ITIN loan may be the key to owning your home. No Social. ITIN Mortgage Loan Program Requirements · 2 years of tax returns using your ITIN number (ITIN number must be on all tax returns) · 30 days most recent paystub. At a Glance. Individuals with ITIN (Individual Taxpayer Identification Number) can buy homes in the U.S.; They can use their ITIN to apply for a home loan. An ITIN mortgage is a type of home loan that is available to individuals who do not have a Social Security number (SSN), but have an Individual Taxpayer. Individual Tax Identification Number (ITIN) loans are for borrowers who do not have Social Security numbers. Borrowers with ITIN cards can qualify for a. If you've filed income taxes in the United States for at least two years, you can apply for a home loan with an ITIN number. We'll help you understand ITIN.

Mortgage Dealer

Take the first step by requesting a free rate quote or call () to get started on a cost-saving mortgage solution on your home. Please find below 's best mortgage lenders in New York, NY. Use the filters to refine or expand your mortgage lender search. We, at MortgageDepot offer superior customer service and access to a wide variety of mortgage programs. Whether you are buying your first home or are a seasoned. Mortgage Licenses. Mortgage License Types. Explanation of the Exempt Mortgage Code Registration. Mortgage Registration Exemptions. Mortgage Broker License. California issues three different types of mortgage broker licenses, all of which involve different licensing requirements and application processes. Nearly all states mandate a mortgage broker bond for licensure. The Merchants Bonding Company Hub streamlines bond issuance with instant pricing. Maple Tree Funding is an experienced NY mortgage broker offering home loans at competitive rates! We can help you buy your first home, refinance & more. A mortgage broker is a type of broker who matches home loan seekers with lenders offering the best loans for their needs. They can save borrowers an enormous. We scored New York City Mortgage Brokers on more than 25 variables across five categories, and analyzed the results to give you a hand-picked list of the best. Take the first step by requesting a free rate quote or call () to get started on a cost-saving mortgage solution on your home. Please find below 's best mortgage lenders in New York, NY. Use the filters to refine or expand your mortgage lender search. We, at MortgageDepot offer superior customer service and access to a wide variety of mortgage programs. Whether you are buying your first home or are a seasoned. Mortgage Licenses. Mortgage License Types. Explanation of the Exempt Mortgage Code Registration. Mortgage Registration Exemptions. Mortgage Broker License. California issues three different types of mortgage broker licenses, all of which involve different licensing requirements and application processes. Nearly all states mandate a mortgage broker bond for licensure. The Merchants Bonding Company Hub streamlines bond issuance with instant pricing. Maple Tree Funding is an experienced NY mortgage broker offering home loans at competitive rates! We can help you buy your first home, refinance & more. A mortgage broker is a type of broker who matches home loan seekers with lenders offering the best loans for their needs. They can save borrowers an enormous. We scored New York City Mortgage Brokers on more than 25 variables across five categories, and analyzed the results to give you a hand-picked list of the best.

Licensed Long Island Mortgage Broker providing home loans, refinancing and mortgages to residents of Huntington, Long Beach, Garden City, Northport. 21st Mortgage Corporation specializes in financing manufactured home loans and mobile home loans. We underwrite, originate, and service our own loans. (4) If a mortgage banker or mortgage broker intends to allow a licensed mortgage loan originator to originate loans from the licensed loan originator's home. Mortgage brokers need bond amounts between $10, and $,, while mortgage bankers require bonds from $50, to $, Loan originators need bonds. Block Financial Resources is one of the top rated mortgage brokers in New York. Call today for a free consultation () What is a New York Mortgage Broker, Originator or Banker Bond? The Banking Law of the State of New York (Article D) requires all registered mortgage brokers. These statutes outline the licensing requirements, exemptions, and procedures for obtaining and maintaining a mortgage lender or broker license. A mortgage broker is an intermediary who can help you choose the best direct lender for you and get your loan application through the process. The Indiana Secretary of State, Securities Division (“Division”) oversees the licensure, examination, general operation, and compliance of loan brokers. To obtain a Mortgage Broker, Lender or Loan Correspondent license, at least one company officer must complete a course and pass a test. A Real Estate Broker is any person, firm, limited liability company or corporation, who, for another and for a fee, commission or other valuable consideration. Looking for a mortgage broker near you? Browse our directory to find a local mortgage broker in your area. Browse all Wells Fargo Home Mortgage Consultants in the New York to get home mortgage loans, check rates, refinance your mortgage, compare loans. Exclusive to Wholesale. We only partner with wholesale loan originators – mortgage brokers and non-delegated correspondents. Without a retail division, we are. loan products and is neither a licensed mortgage broker nor a licensed mortgage lender. Home lending is offered and provided by Rocket Mortgage, LLC. Rocket. The average mortgage rate in New York is currently % for a year fixed loan term and % for a year fixed loan term. All Mortgage Broker applicants must appoint a Designated Broker. This person must pass the Designated Broker Test before the company applies for licensure. This. In the following disclosure, I=applicant; you=mortgage broker. You have advised me that you are authorized and prepared to assist me in securing financing. I. Use our comprehensive directory to find a New York mortgage lender who can help. View and compare New York mortgage brokers and mortgage lenders. A mortgage broker is an intermediary that works between the borrower and the bank to help the former obtain home loan financing.